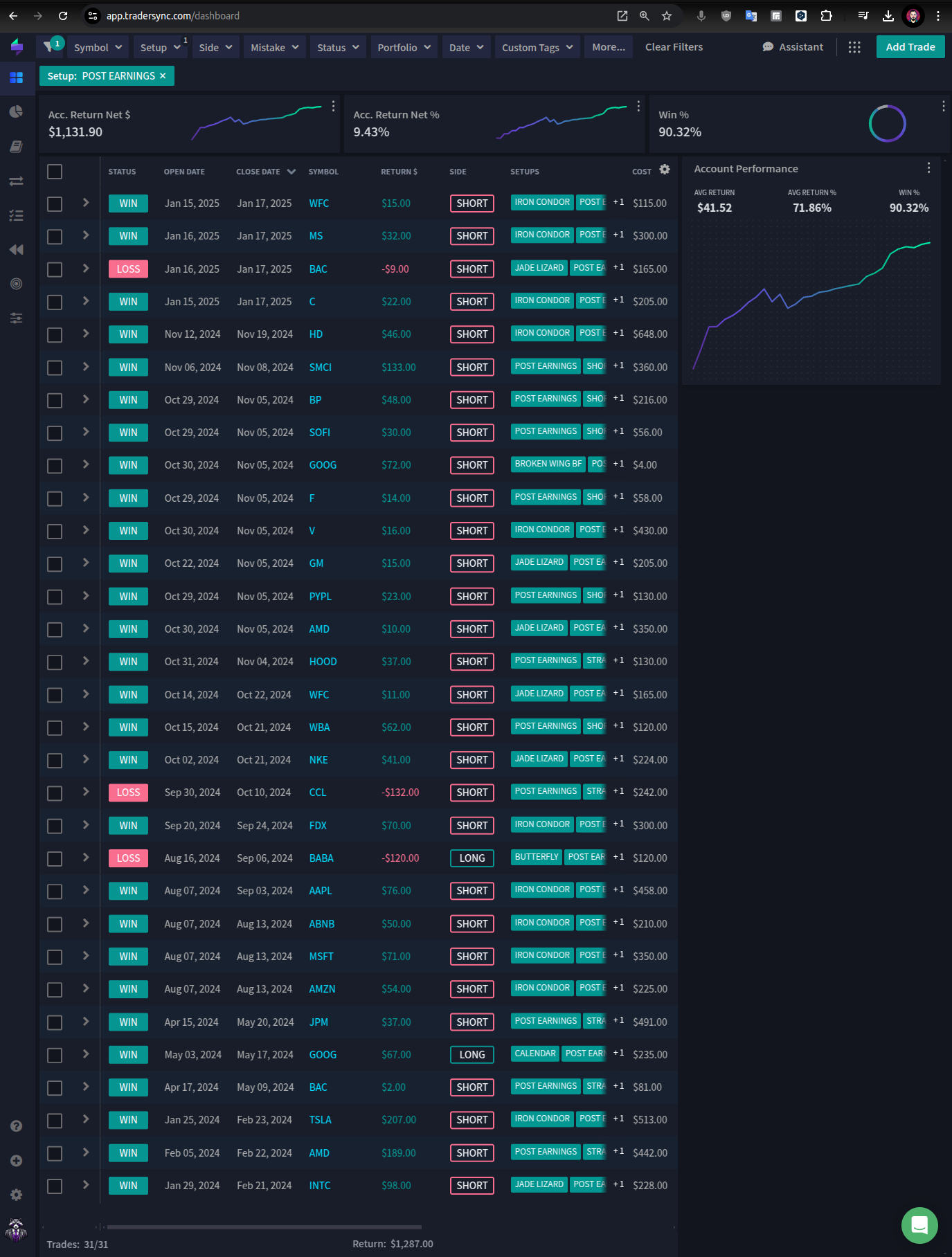

01/20 Using GEX Levels in action — My Well-Functioning Options Strategies for Earnings Season

90% success rate over the past year—that’s exactly what my post-earnings strategy has delivered

~ Quick SPX Outlook ~

Before all….

Looking at the GEX levels through Friday, we can see that since mid-December, the market has been moving in a slightly downward channel.

Above 6000–6025: A call gamma squeeze is expected.

Between 5925 and 6000: A sideways “chop zone.”

Below 5925: The high-volatility zone begins, with 5800–5850 acting as our major support/resistance level characterized by heavy put dominance.

Below that level lies a “total denial zone.” We’ve seen this scenario before—think back to the red candle on December 18, when the price broke below that threshold. This “red zone” is currently around 5800, so below 5925 we can anticipate large-amplitude moves.

At this point, the market still does not seem worried about significant volatility. Until Friday, all NETGEX values for every expiration are positive, so market participants are pricing in more of a sideways movement. We haven’t yet seen a big pickup in volatility.

I’m not pessimistic, but keep in mind that Trump’s inauguration might usher in a high-volatility period—something the market and many retail traders haven’t experienced in a while. Better safe than sorry.

~ My Well-Functioning Options Strategies Using GEX Levels for Earnings Season ~

Below is a concise, structured explanation of how to leverage “post-earnings” trades and GEX levels together. I’ve been testing these strategies live for one years, and the results speak for themselves ….. over 90% of success:

1. Why Focus on Post-Earnings Trades?

Earnings Season Reality

Many traders mistakenly try to profit from the volatility collapse before earnings. However, my research shows that implied volatility (IV) remains elevated even for longer-dated expirations and only gradually decreases after an earnings announcement.Post-Earnings IV Drop

By initiating positions right after the earnings release—on the very first trading day post-announcement—you can often capture an additional IV melt on these longer-dated options.

2. What Are We Looking For?

Recent Earnings Release with IVR

A stock (symbol) that reported earnings last night or this morning, with a clear price reaction and an Implied Volatility Rank (IVR) still at or above 20.Liquid Underlying Over $100

To ensure tighter strike intervals for multi-leg option strategies and manageable slippage.Clear GEX-Based Trading Range

Use GEX (Gamma Exposure) levels to identify a likely trading range for the “optimal monthly” expiry (usually 45–60 days to expiration).Neutral or Omni-Directional Outlook

You can lean slightly bullish/bearish, or stay delta-neutral, depending on your market view for that stock.

3. Strategy Selection

Focus on expirations around 45-60 DTE (e.g., the upcoming monthly cycle). These strategies benefit from falling IV, plus theta decay. If necessary, you can adjust (“roll”) the untested side to control risk.

Beginner Strategy

Iron Condor (can be directional or asymmetric legged).

Intermediate Strategy

Advanced/Expert Strategies

Short Put

Short Strangle

Key Point: You need to understand that declining IV and the passage of time both work in favor of these strategies. And if both happen simultaneously, your odds of making a profit are quite high. Even with a small account, you can participate—an iron condor requires relatively low buying power over $100 stocks.

4. Trade Management

Keep net delta low by structuring short strikes around GEX-determined ranges. If price moves against you, roll the untested side to maintain a neutral or lightly directional bias.

Shorter Holding Period!

Although we open around 60 DTE, we rarely hold to expiration—or even half the time. Typically, I exit within a week, aiming to capture the post-earnings IV drop alongside theta decay.If you can net around 5–10% of the required buying power in about a week, that’s an excellent return for this “IV melting” scalp approach. Fridays or other low-volatility days often provide good exit points.

5. Pro Tip for Newcomers

If this still sounds confusing, try a demo trade:

On the first trading day after earnings, open a 25-delta/25-delta Iron Condor (net delta near zero) on a liquid stock above $100 with about 60 DTE.

Monitor it for a week. You’ll likely be surprised at how quickly the profit accumulates as implied volatility contracts.

You can play with the short rolling up/down or the entire vertical rolling up/down.

In Summary

Post-earnings trades can be highly effective during earnings season—particularly when combined with GEX levels to define probable price ranges. You’re capitalizing on both the lingering IV in longer-dated options and the typical volatility drop in the days following the earnings release. By carefully managing delta and exiting within a short time frame, you can generate steady returns while minimizing risk.

~ Real life examples ~

#1

32$ gain in 1 day scalp! MS 0.00%↑ directional IC ~ synthetic jade lizard for

Trade journal entry: https://shared.tradersync.com/tanukitrade/2417d951-d439-11ef-8016-0644527c0839

#2

$40 HD 0.00%↑ IV Scalp in One Week

Trade journal entry: https://shared.tradersync.com/tanukitrade/1e8cf62f-a5cb-11ef-8b96-0644527c0839

#3

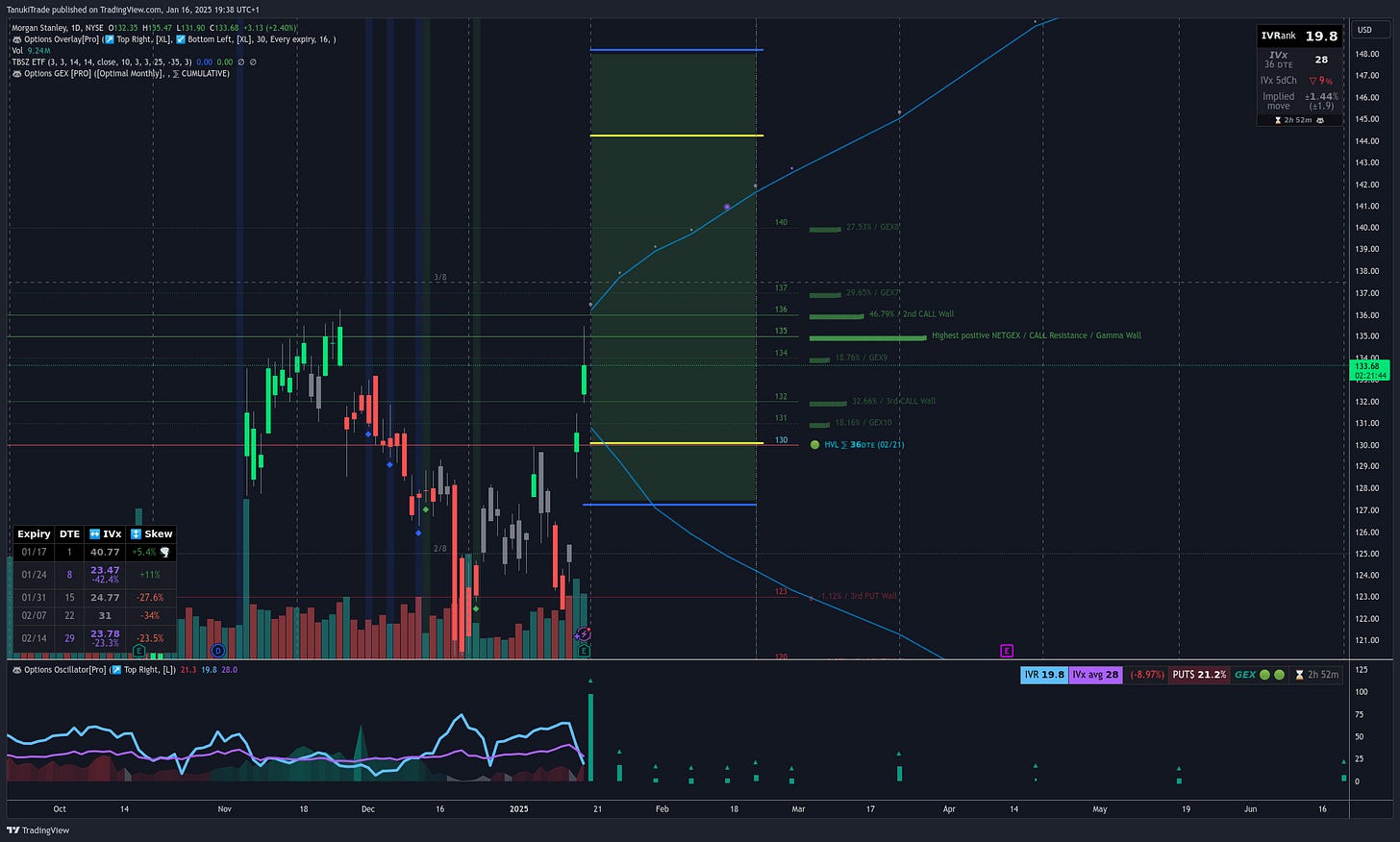

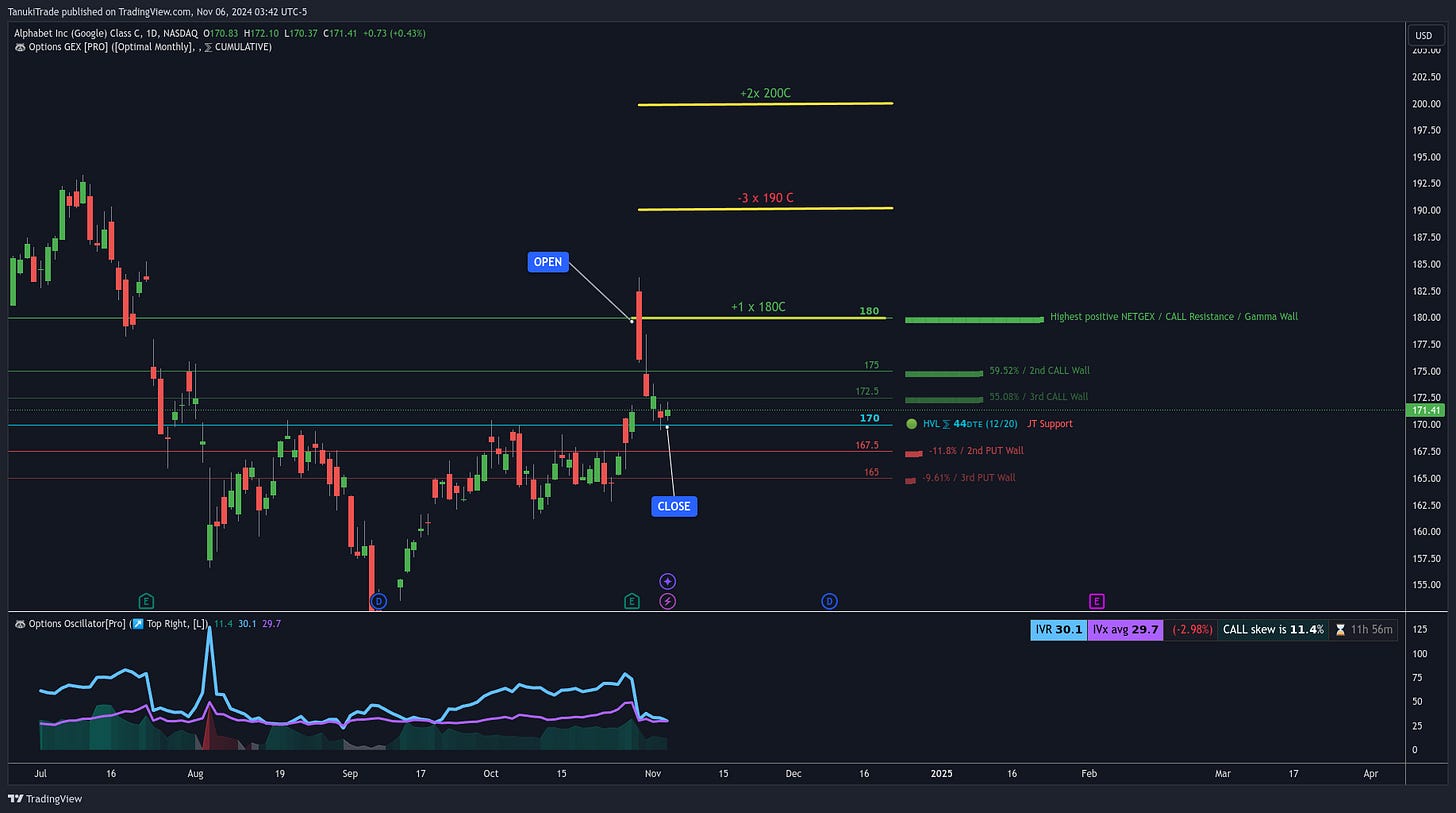

GOOG 0.00%↑ $64 Profit in One Week

After the earnings announcement, I noticed the price had rebounded sharply from the call resistance level. Seizing that momentum, I opened a flat 1/-3/2 call butterfly for a net credit above the current GEX levels.

One week later, thanks to the drop in implied volatility, the position looked like this:

#4

C 0.00%↑ bearish IC Even though it went against me I still made a $22 scalp in 2 days

After Citigroup’s earnings release, our indicator clearly signaled a bullish gamma squeeze. But whether the price pulled back or continued higher, we anticipated staying in positive gamma territory—somewhere between 75 and 80.

Trade journal entry with screenshots: https://shared.tradersync.com/tanukitrade/f19c9c34-d368-11ef-8016-0644527c0839

That’s why I chose a closer-to-the-money iron condor, which also carried a slightly negative delta (allowing for a minor pullback). Two days later, even though the price nearly tested the short call leg, I still managed to close the trade in profit—another successful IV scalp.

With the examples above, I hope I’ve demonstrated that there’s no need to take on unnecessary risk before earnings. You can still capture small but high-probability gains by scalping IV after the announcement. And as we all know, a series of small profits can add up significantly over time.

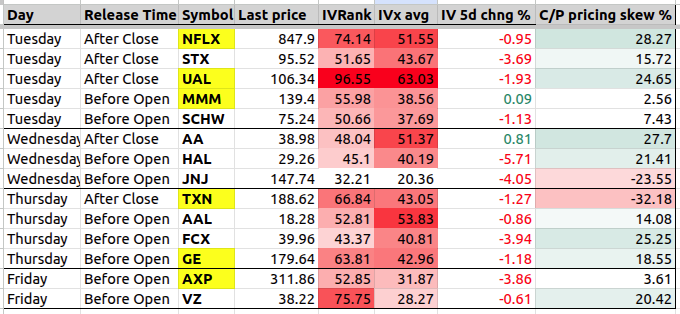

Here are this week’s earnings announcements so you can try out the above strategies with our GEX levels—even if only in a demo account or using OptionStrat.

Below are the upcoming earnings report dates for the week. Please note that I prepared this list on Friday, so the numbers may have shifted slightly since then.

Oneclick-save TradingView Watchlist is here

or Google Sheet

I’ll pay special attention to the symbols highlighted in yellow ( NFLX 0.00%↑ UAL 0.00%↑ MMM 0.00%↑ TXN 0.00%↑ GE 0.00%↑ AXP 0.00%↑ ), chosen either for their high IV or their notable call/put pricing skew.

Don’t try to be a fortune-teller before earnings! Trade more safely after the announcement, when the binary risk has passed. Small profits add up in the long run, and you can still scalp IV without sending your blood pressure through the roof.

Stay safe and trade responsibly!