11/11 Weekly Options Market Insights

Key GEX Market Movements, Earnings Strategies, and SPX Levels to Watch

As usual, let's take a look at the current state of the market.

The post-election hype in the U.S. is still palpable. Last week, several stocks, notably TSLA, experienced a gamma squeeze, triggering significant bullish movement with new breakouts:

The price continues to rise turbulently with increasing implied volatility (IV) and call pricing skew. Across all expirations, we're above the call resistance level, with strong buying pressure in the market, especially in pre-market sessions.

A longer-term bearish sentiment would only likely develop below HVL 237.5, which is still quite distant. Even with minor corrections, a broader bearish trend seems unlikely in the near future.

SPX Level and Gamma Wall

Following the election, the SPX price was held by the 6000 gamma wall by the end of the week. This level is critical, as it represents significant resistance to bullish moves.

🎯 Cumulative gamma profile through Friday (4DTE)

Watch the 6000 level closely; it could determine the market’s direction this week. Both IV and the PUT pricing skew have significantly dropped, indicating growing bullish sentiment.

NETGEX for every expiry

If we break above 6000, bullish movement could strengthen further, potentially triggering another gamma squeeze similar to what we saw with TSLA. The next call resistance levels are expected around 6050 and 6100.

The Plan - watch GEX at lower timeframes - zDTE

For more granular analysis, it’s useful to look at 0DTE levels, focusing on shorter timeframes. For today’s 0DTE GEX, three main scenarios are possible:

Bullish Breakout: If we hold 6000, look for bullish movement up to 6022, where partial profit-taking may be wise.

Sideways Movement: A chop zone could form between 5990 and 6000.

Bearish Scenario: If we drop below 5990, expect a swift downward move to around 5965.

📅 Key Events

Core inflation data is expected on Wednesday, with Powell speaking on Thursday, which could trigger a technical pullback – something worth waiting for.

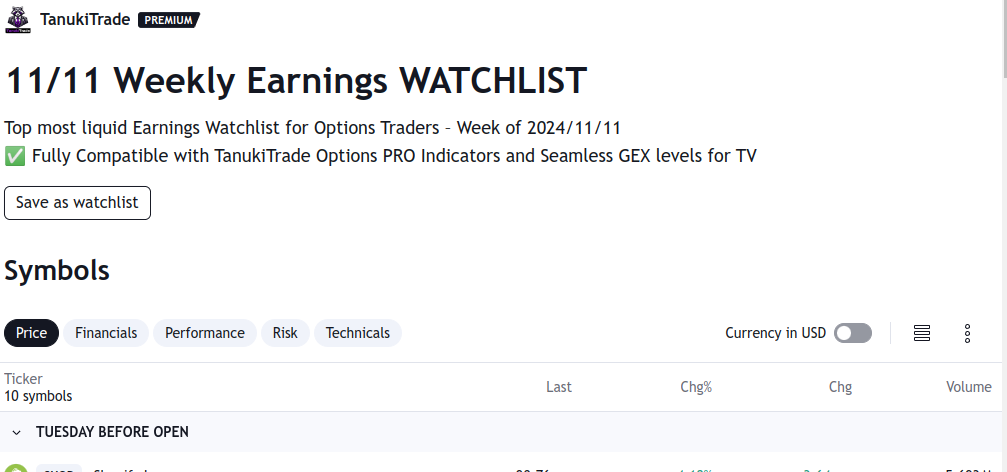

Earnings for this week

This week's earnings reports are available in a curated TradingView watchlist that you can save to your own list with one click: [Tradingview Watchlist link]

Additionally, I’ve created a separate Excel sheet highlighting upcoming earnings releases and their current values, available here: [Excel link]

Post-Earnings Strategies

Post-earnings trading focuses on leveraging IV decay. Here’s my approach:

Wait for the earnings announcement.

Monitor price stability for at least 30 minutes after the market opens.

Select a strategy and direction.

It’s important that IV and IVR remain elevated post-earnings (e.g., IV above 30 and IVR above 25-30). If these criteria are met, the stock could be a good candidate for a post-earnings trade.

Timeframe

The optimal timeframe for post-earnings trades is usually the next monthly expiration. Currently, December 20 is the target expiration, as theta decay is most effective over this timeframe.

Earnings Move Study

Tastytrade recently shared an interesting study on post-earnings movements, showing two key patterns:

If the price moves outside the expected move zone, the new trend often aligns with the gap direction.

If the price remains within the expected move, the prior trend tends to continue.

Considering these earnings reactions is essential. If uncertain, you might explore an Iron Condor formation or a simple short put option after bullish earnings.