Kickstart 2025: SPX GEX Outlook & Options Insights

New Year, Renewed Energy — Critical Levels and Strategies for the Week

Happy New Year, everyone!

First off, I’d like to apologize to those who were expecting an update sooner. Over the last two weeks, I was focused on the holidays and family. I personally need that year-end downtime, and I believe there’s no harm in stepping back from trading if we’ve been at it all year.

Now, let’s kick off the new year with renewed energy! This newsletter will be shorter than usual, because I’ll send another one later this week to make up for missed updates and include a full annual performance review.

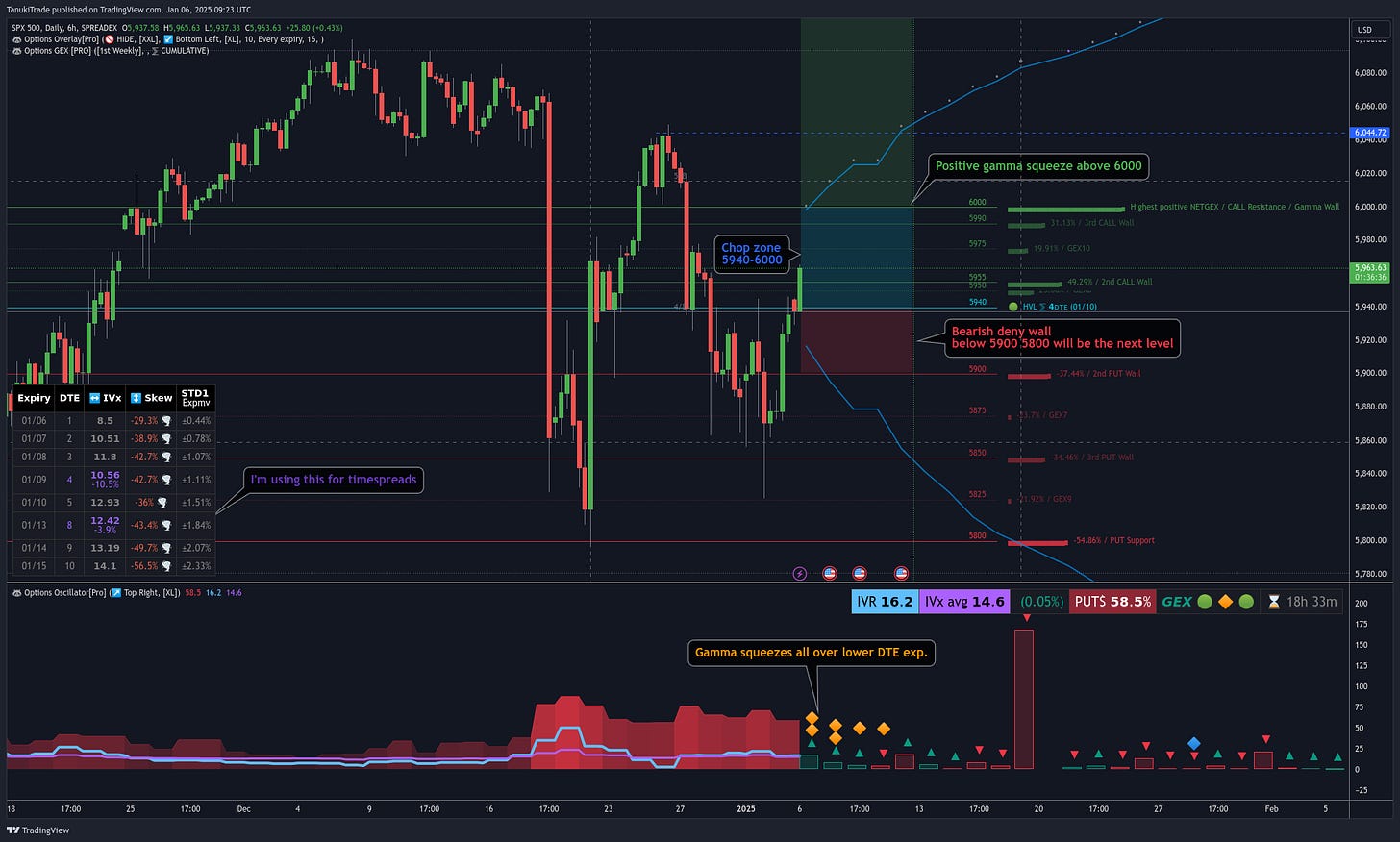

SPX Weekly Outlook Based on GEX Levels (First Week of the Year)

Critical Levels

Above 5940 (HVL): Expect some “chop zone” between 5940 and 6000, but with a generally bullish bias based on our Auto-GEX Profiles until friday.

Above 6000: A gamma squeeze could ignite by Friday, pulling the index toward the next major resistance.

Below 5900: Significant bearish momentum may take hold, targeting around 5800 (PUT support), though this scenario seems less likely right now.

Gamma Conditions

Short DTE options (0–2 days) exhibit positive gamma, which tends to buoy prices and make steep sell-offs more difficult.

There’s notable IV skew in the very near-term expirations (01/08–01/09). Consider focusing on the Friday (01/10) and Monday (01/13) expirations for timespread strategies.

Option Trading Insight

Timespread: Avoid the high IV distortions on 01/08–01/09; instead, exploit the potential volatility differences between 01/10 and 01/13.

I opened diagonal spreads near the previous local highs last Friday. The maximum loss is about $155 to the downside—which is quite reasonable for a 4/7 DTE setup—and the max profit could reach $2,523.

You can follow the simulation over the week here: https://optionstrat.com/pEUKV59BJEMt

Summary

Upside: Holding above 5940 supports a move toward the 6000 target.

Above 6000: A gamma squeeze could propel the SPX higher.

Below 5900: Watch out for a stronger bearish move toward 5800.

IV and skew may be erratic this week, but the positive gamma backdrop favors upside momentum.

In short: Staying above 5940 through Friday favors the long side, with 6000 as a key target. A breakdown below 5900, however, could trigger a sharper sell-off.

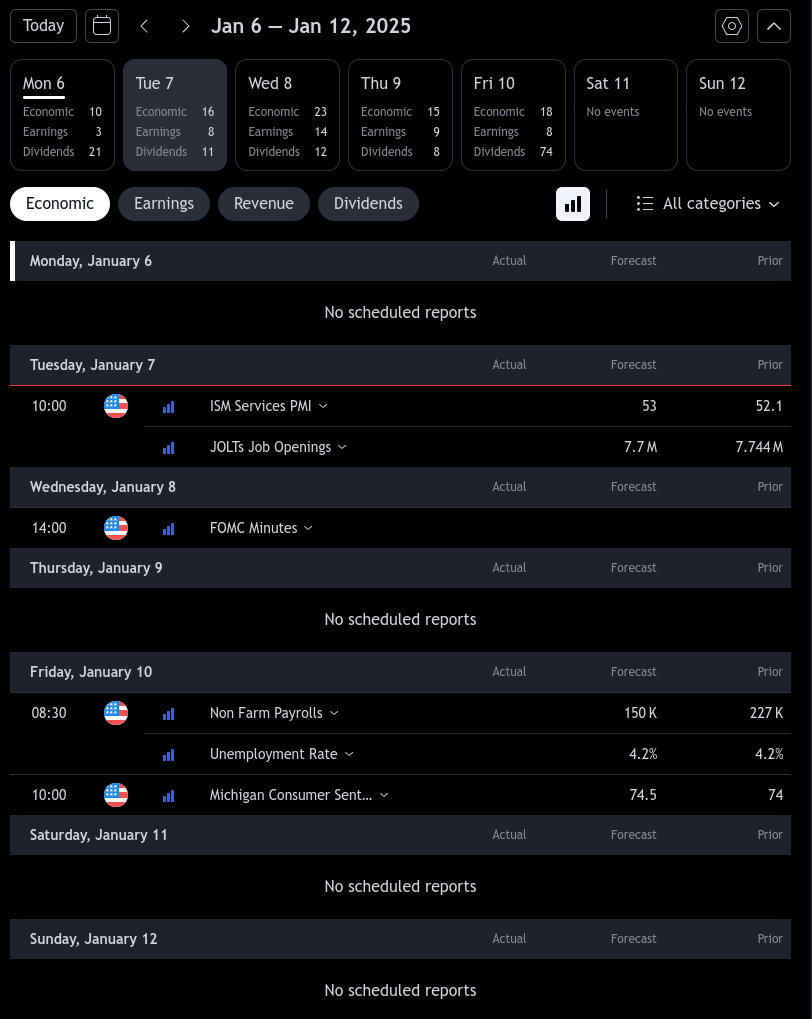

Weekly Economic Calendar

There are several announcements due this week. If price whipsaws around these times, remember it’s often directly tied to those scheduled news releases—try not to panic.

Wishing everyone a responsible and successful year of options trading in 2025!

How do you determine your time spread strikes?