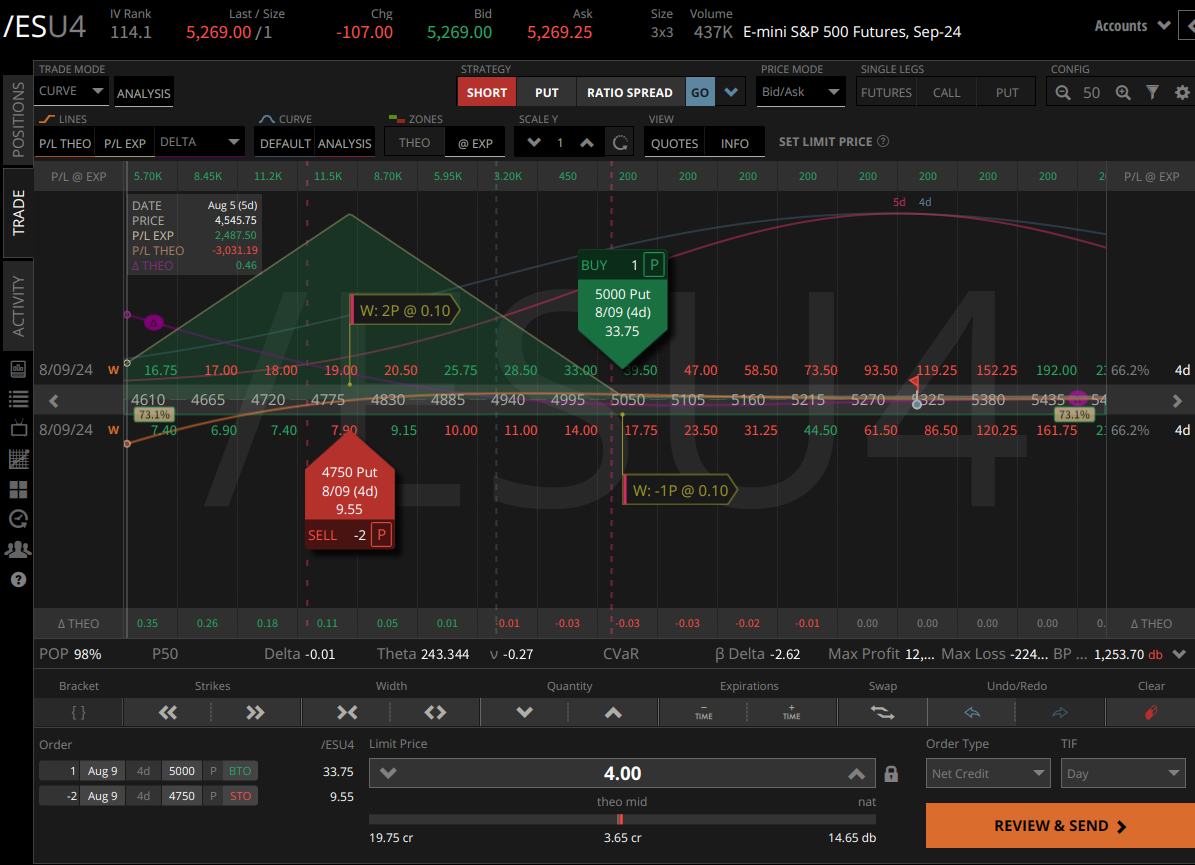

TanukiTrade Weekly Newsletter 8/5/24

Each week, we break down everything you need to know about the stock market for the week ahead, whether you're an active or passive trader.

Market Outlook: VIX, SPX

Last week, a minor panic emerged on Wall Street due to poor economic data. The VIX was already high by the end of last week, but it has now hit the 40 level before today's market open. The last time we saw such an impulsive spike was during the COVID-19 panic in 2020. We know the VIX: it rarely climbs this high, but when it does, it’s intense and short-lived.

Accordingly, the IVRank for the $SPX is at 114, indicating that IV values on the options chain have only been lower over the past year. Examining the 47DTE (September 20) expiration, we see that PUT options at the expected move distance are twice as expensive as CALL options at the same distance.

Let’s visualize the options chain state with our Options Overlay Indicator for Tradingview. The brown line indicates the symmetric expected move over time. The gray zone, enclosed by the outer STD1 curve, represents the probability field within which the price is likely to move 68% of the time as time progresses.

The blue lines mark the 16 delta OTM options, clearly showing how the pricing has shifted south. The 16 delta OTM CALL is 5.6% away from the current price, while the 16 delta PUT is 8.11% away, looking at the September 20 expiration (±299 was the Expected Move - brown line ).

This is a rare occurrence for the SPX, so options traders should consider capitalizing on this state.

Considering the murreymath grid system, we see strong resistance at 5000 due to the 4/8 level. Even if the price overshoots, it usually acts as a magnet, making a retest to this level likely.

What strategies should option traders use now?

We know the current state favors PUT selling strategies. I caution against buying single-legged options, whether CALLs or PUTs.

However, the current state is favorable for short PUT, short strangle, iron condor, PUT ratio, and broken wing butterfly strategies. It’s worth looking for a bottom formation in a smaller time window to leverage the high IV and Vertical Put Pricing Skew with a weekly credit strategy to ride the panic wave.

Keep in mind that although farther out (15+ days) options have higher theta, in this case, it’s the vega driving the real value of options. So, focus on setups that better utilize volatility over theta.

As an example, a 4DTE PUT ratio spread has a wide breakeven and can produce at least a 10% ROI on the involved buying power, as long as the price doesn’t significantly drop below 5000 by Friday.

However, be aware that the bid/ask spread is very wide, so pay close attention to your trades. This is not investment advice!

Economic Calendar & Earnings

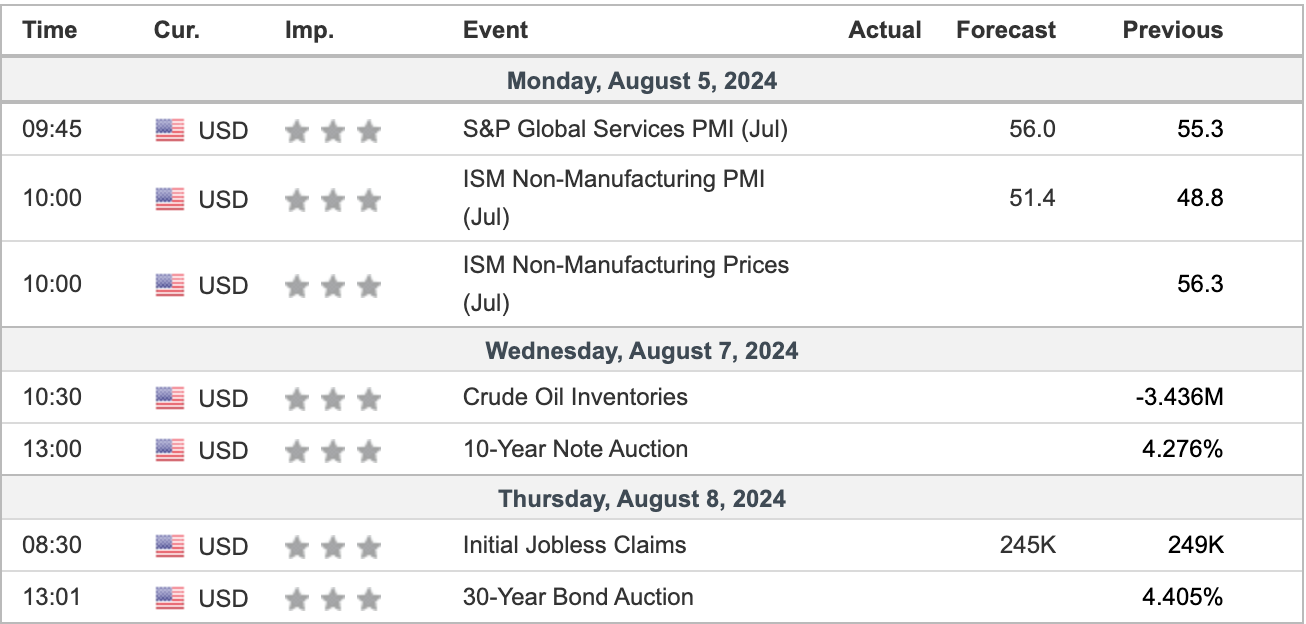

This week has numerous event risks according to the economic calendar:

Source: investing.com

Earnings season also continues:

Here’s our watchlist based on the TanukiTrade Options Screener:

Monday: PLTR 0.00%↑ , UBER 0.00%↑ , CAT 0.00%↑ , MPC 0.00%↑

Tuesday: SMCI 0.00%↑ , RIVN 0.00%↑ , ABNB 0.00%↑ , WYNN 0.00%↑ , UPST 0.00%↑ , SHOP 0.00%↑ , CVS 0.00%↑

Wednesday: HOOD 0.00%↑ , OXY 0.00%↑ , LLY 0.00%↑

Thursday: U 0.00%↑ , PARA 0.00%↑

No trading on Friday—prepare for the weekend as nothing much is expected!

Anyway, it's going to be an exciting week ahead, with plenty of opportunities in the market.

Greg, how do you use the Options Overlay indicator for earnings?

It’s simple. I set the 16 delta and the probability field, then, strictly before market close, I enter a put credit ratio spread where:

PUT options are overpriced

There is significant support (-4/8, 0/8, 4/8, 8/8) below

Support is significantly far from the current price, extending up to 45 days depending on the exact scenario

Alternatively, if I’m uncertain, I wait for the earnings report and then immediately enter a strangle/IC if I can set one far enough out. Based on my experience and research, after earnings, while IV collapses, the price usually doesn’t make a major move from where it opens. This is particularly true for large-cap stocks.

Take care this week and trade wisely!