12/09 Weekly SPX Insights & Educational Outlook

Navigating Key SPX Levels, Gamma Exposures, and Upcoming Enhancements: An Educational Market Overview

Another week, another set of market dynamics to observe. Let’s take a step back and review some key levels and scenarios for educational purposes using our Options toolkit on Tradingview. Remember, this commentary is intended for risk-aware analysis and learning, rather than providing direct trade recommendations.

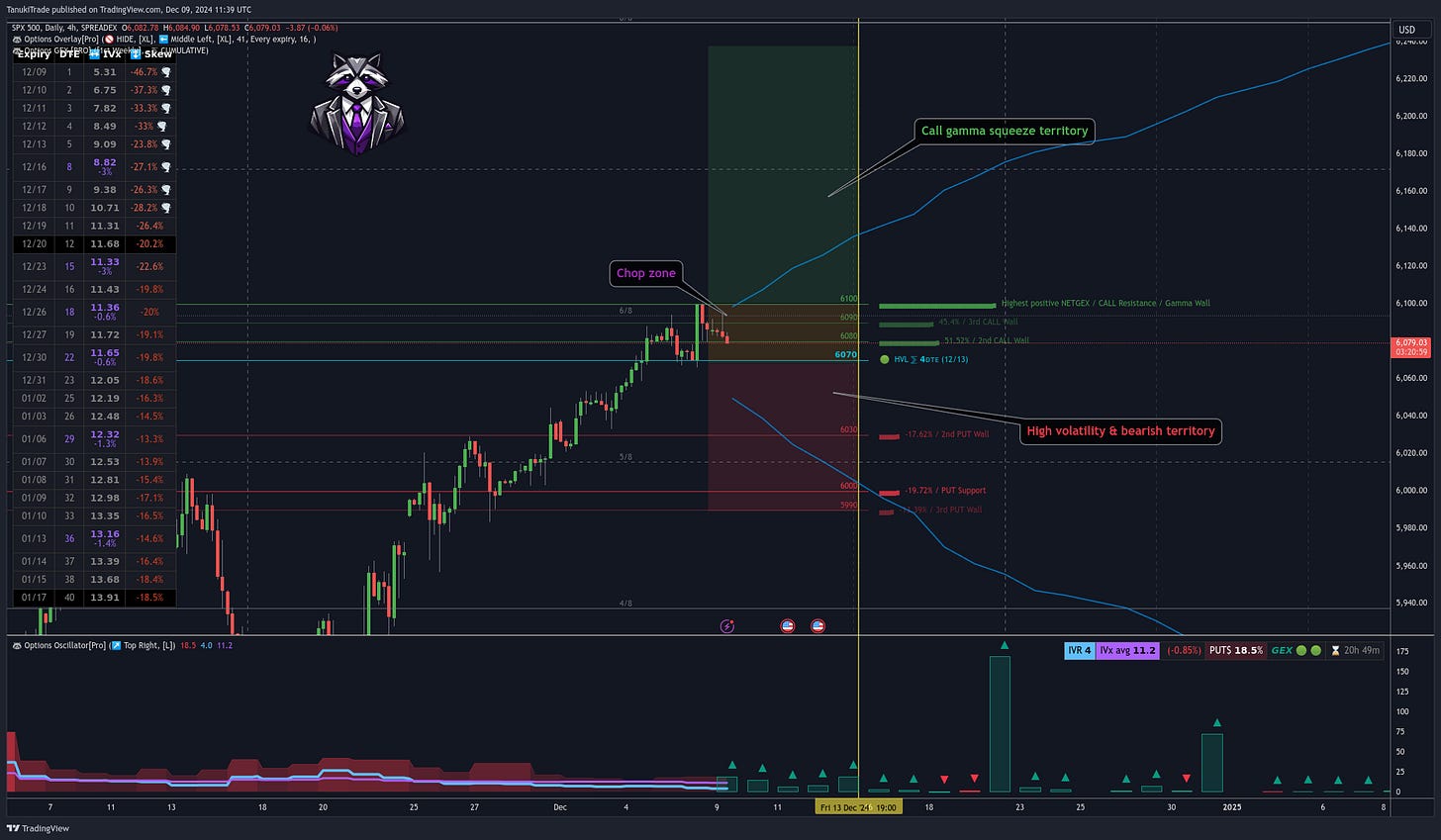

SPX Market Overview

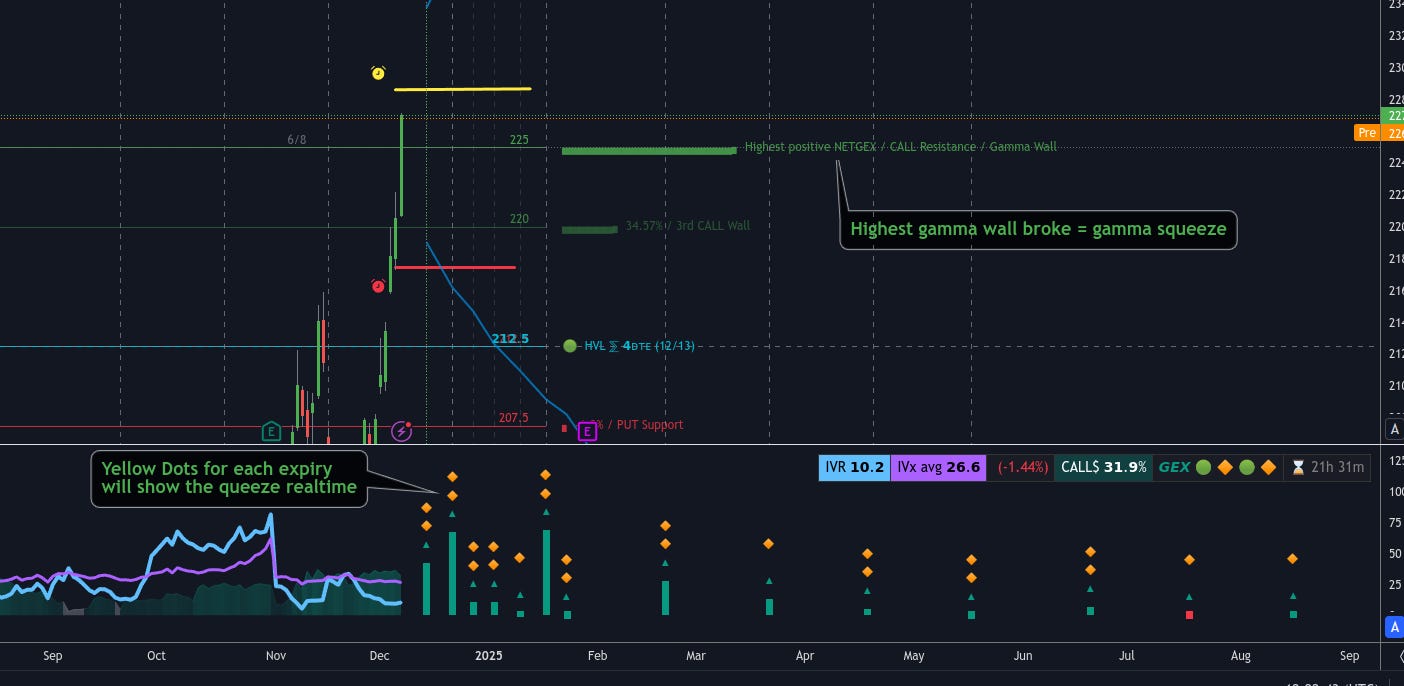

Last week’s assessment aligned well with the anticipated positive SPX range. The index moved sharply up toward the 6100 area, yet as Friday’s session progressed, the call resistance around 6100 capped further upward momentum.

Looking ahead, I have doubts that the previously unbridled optimism will persist. Currently, we find ourselves in a “chop zone,” suggesting that the short-term direction is less clear.

In aggregating GEX (Gamma Exposure) levels and examining the landscape a week out, it appears that 6100 remains a strong call resistance level. Meanwhile, the HVL (High Volatility Level) has crept closer to around 6070, placing the market uncomfortably close to a higher-volatility environment. Below 6070, the market may experience increased turbulence, potentially retesting 6030 and then 6000.

On the other hand, if the index can break and hold above 6100, an upward gamma squeeze could emerge, pushing prices even higher. Currently, overall GEX sentiment is still positive, but the approach toward the HVL zone suggests caution. From these conditions, I’m not expecting a strong, sustained rally in the immediate term.

In terms of intraday and short-term dynamics, 0DTE (same-day expiry) sessions and Fridays continue to hold relatively higher positive gamma exposure compared to other days.

Volatility indicators:

VIX: remains low

IVR (Implied Volatility Rank): also low

Put Pricing Skew: currently low, although it has begun to show a very slight uptick

Key Levels for This Week (for educational reference):

Above 6100: Omni-bullish environment

Between 6100–6065: Chop zone (directionally uncertain; not ideal for unhedged directional trades)

Below 6065: Bearish tilt, with targets around T1: 6030 and T2: 6000 (near the 16-delta OTM put level)

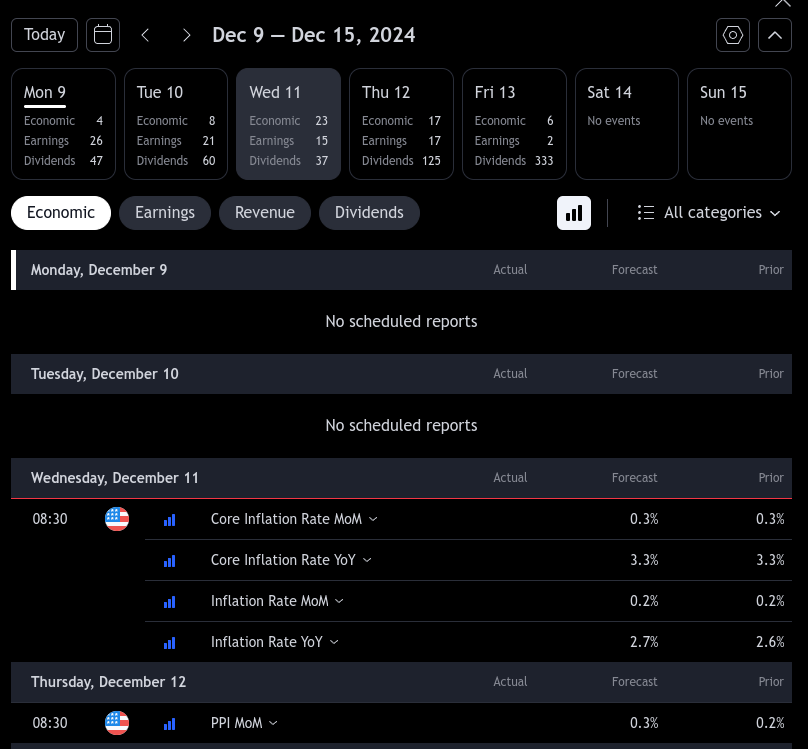

Upcoming Events

On Wednesday, inflation data is scheduled for release. Anticipation alone may drive volatility, so it’s something to keep on the radar for educational scenario planning.

Educational Trade Reviews from Last Week

We’ve been tracking two time spread combinations as test cases for educational purposes, focusing on how to manage, adjust, or close these trades under various conditions.

TEST CASE [A] Follow-Up

Timeline:

12/02: Open a 4/7 DTE setup for demonstration.

12/04: Notable volatility emerged; short legs were approached.

Removed risk and locking in profit once the position is challenged.

12/06: Ultimately expired the position with a $715 profit in 4 days with initial 1000$ capital requirement (https://optionstrat.com/SDptB1QCrCFg)

This scenario underscored the importance of active management, taking advantage of favorable shifts in implied volatility, and knowing when to scale out or close diagonals and calendars.

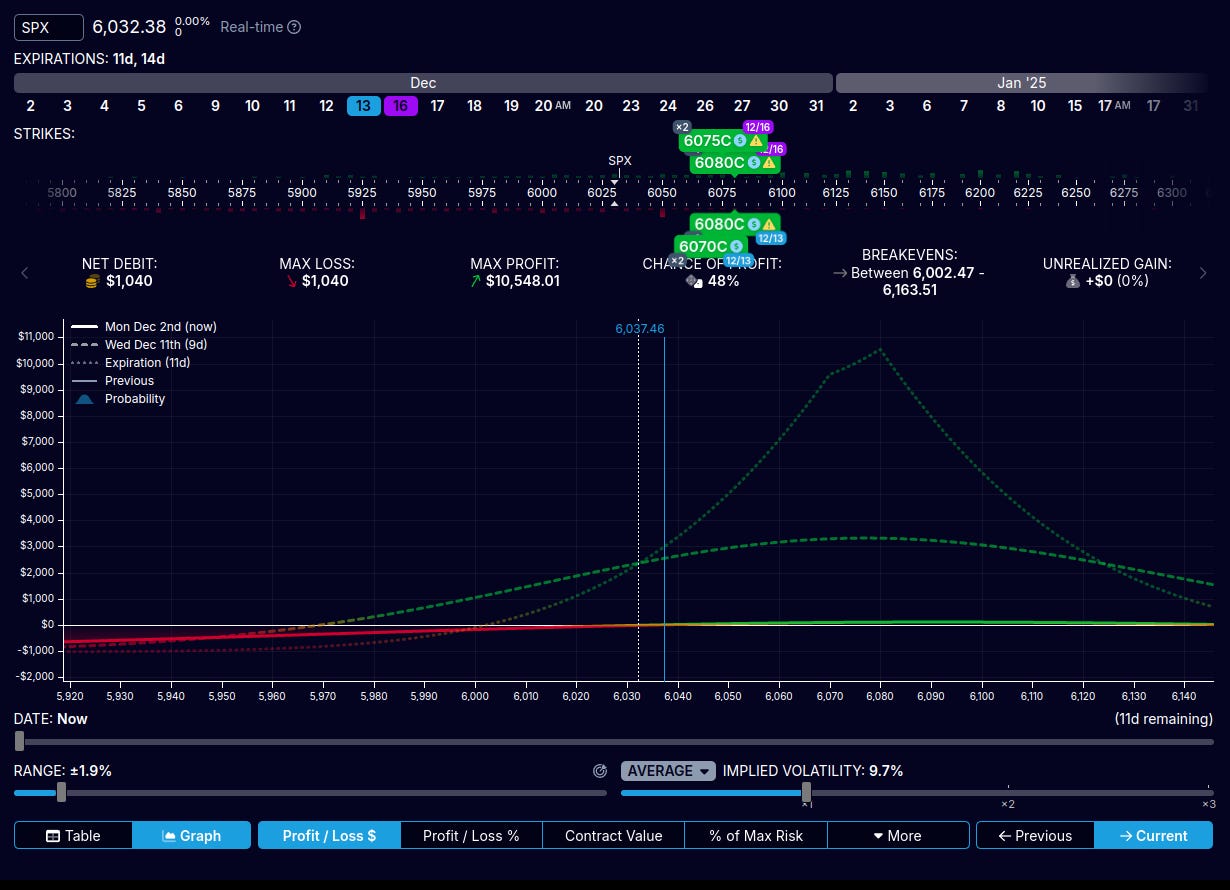

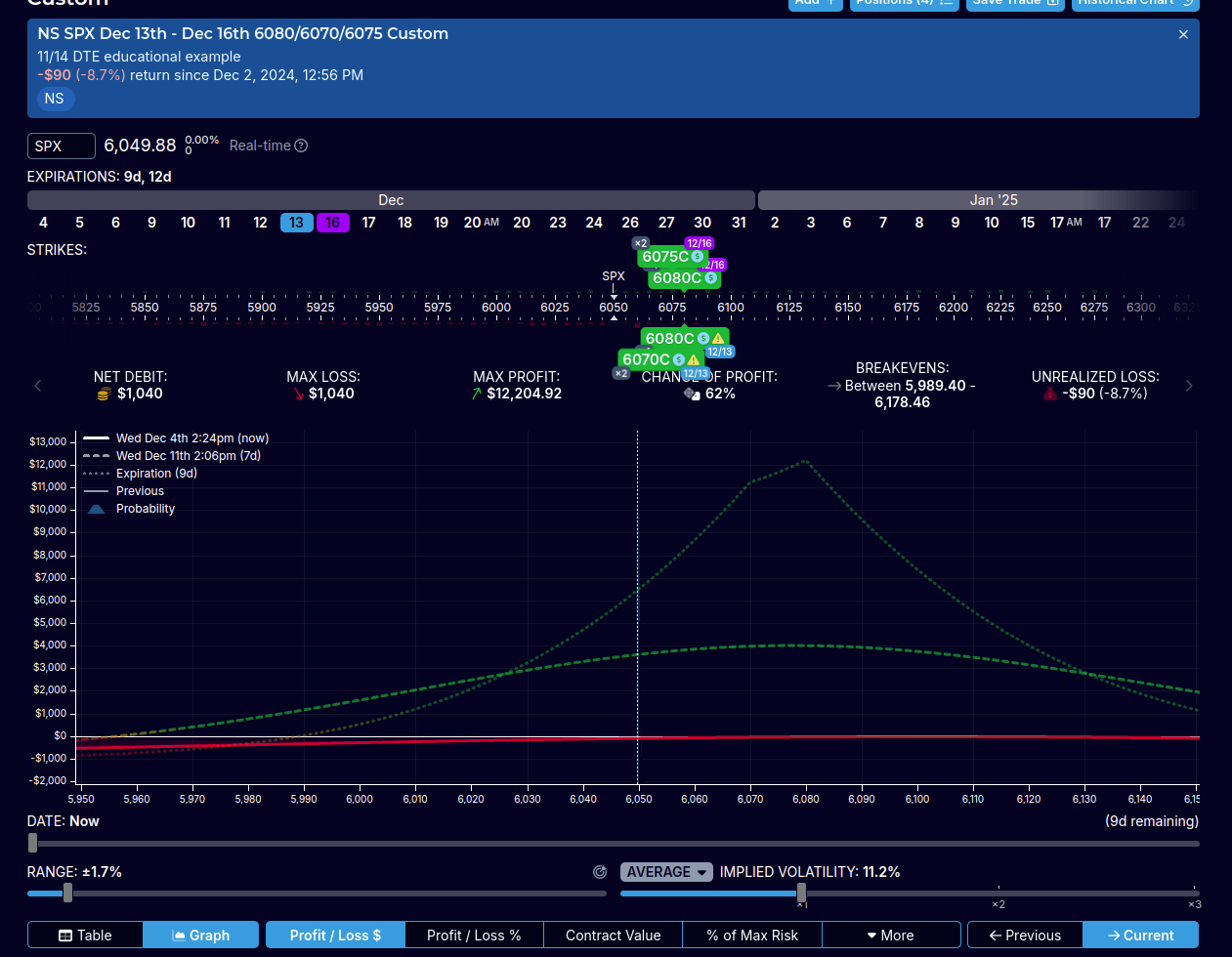

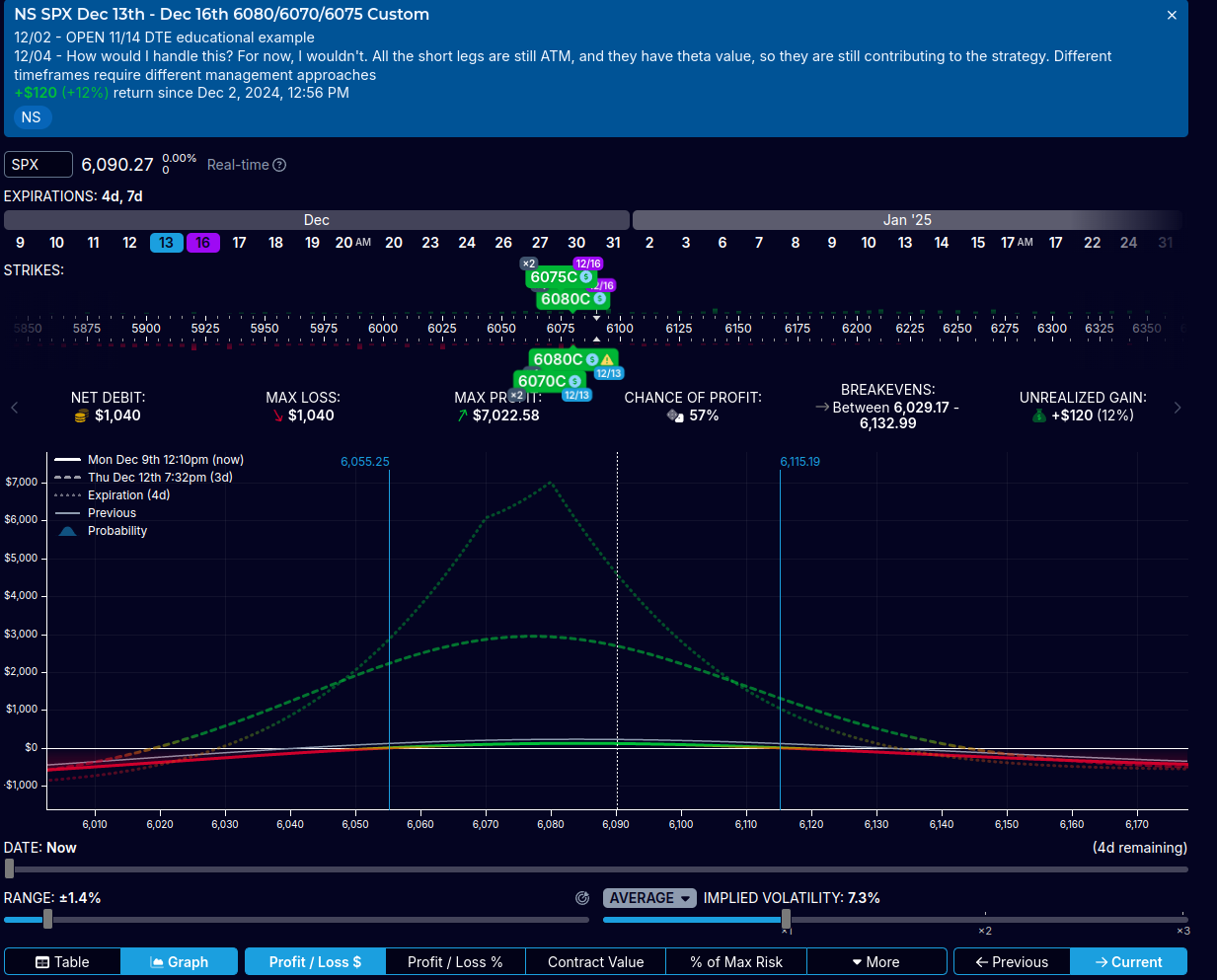

TEST CASE [B] Follow-Up

Timeline:

12/02: Initiated an 11/14 DTE educational example.

Initial Approach: If the short legs remain ATM, they retain theta value. Different timeframes warrant different management techniques—no rushed decisions were made early on.

12/04: Still holded, with positive delta (1.24) indicating mild directional risk.

Remaining patient can be a strategy, but one must be prepared to adjust should the price move against the structure.

As of 12/09 (TODAY), the position hovers around an ~$120 floating profit, with the short legs slightly ITM:

The key educational takeaway now:

Never allow ITM short legs to approach expiration without adjustment. About three days before expiration, the profit profile can degrade rapidly if left unmanaged.

Possible Adjustments NOW:

Close the position for and run away (very good, no problem)

Close for a small profit, then re-establish a structure at a higher strike (roll the entire setup 30–40 points higher for a credit), effectively removing ITM risk and potentially benefiting if SPX remains between roughly 6000 and 6100.

Given our GEX-based expectations (an environment supportive of this type of roll), we’ll test the second approach for its educational value. By repositioning the trade closer to the current price, we align it with this week’s anticipated 6000–6100 range. Upside risk management is crucial, especially if the 6100 level is decisively breached, as the upcoming inflation data release could trigger larger-than-expected swings.

For added caution and to accommodate potential volatility, we might open just two diagonal spreads after closing the current structure.:

https://optionstrat.com/elL6UJHsIseq

We could place new short strikes around 6115 and long strikes around 6120. This approach adjusts the risk profile and provides a more controlled environment for learning from this scenario, effectively removing downside loss potential and making the structure nearly risk-free on the downside, while still allowing for modest upside gains. The delta is now slightly negative, shifting the original bullish outlook to a mildly bearish stance.

For risk management purposes, promptly close any positions if call resistance (6100) is breached with significant volume.

Roadmap and Upcoming Developments

Many of you have been asking about future updates and new features, so here’s our current schedule fo TanukiTrade Options:

By the end of Q4 2024: ENHANCEMENTS

Indicator Improvements: We’ll fix existing bugs and incorporate GEX levels into the overlay expiry table.

/MES Support: By popular demand, we’ll extend the same functionality currently available for /ES.

HVL Fix: The HVL currently obscures larger GEX levels, and we aim to resolve this issue.

Additional Surprises: We’re planning a few enhancements to help you interpret price action more easily, such as gamma squeeze alerts and key level highlights.

By the end of January 2025: DISCORD

Discord Server Launch: We’ll open our dedicated Discord server featuring various scanners that go beyond what’s possible on TV.

Community & Education: Expect daily market analysis and dedicated “educational trades” to foster a learning environment within the community.

By the end of Q1 2025: WEBAPP

Web Application Launch: Gain deeper insights into GEX levels and volume with more frequent updates.

Predefined Searches: Effortlessly identify gamma squeezes by symbol, sort by IVR, and access predefined scans to assist in strategy selection (e.g., backwardation filter).

Educational Materials: We’ll provide guidance on how to interpret options metrics, addressing a common question from the community.

This roadmap will help clarify what’s coming and how we plan to enhance your understanding and usage of these tools. Stay tuned for more details and updates!

What Would You Like to See More Of?

More detailed breakdowns of my really closed trades, exploring the reasoning behind each profit or loss?

Deeper dives into GEX-driven analysis on various markets, not just SPX?

Both?

Your feedback helps shape future educational content, so feel free to share your thoughts in the comments.

I would like to see both topics in the future. I'm really looking forward to all the expansions you have planned.

With last week's trade, I made good money and learned something. I'm very satisfied. Please keep it up.